What Is Box 1 On Vat Return . Fill in the necessary fields, then click. This might also include vat on other outputs, such as. Uk vat registered businesses should also. Vat due on sales and other outputs. Web click taxes, then go to the vat tab. Vat due on sales and other outputs this box should include the total amount of vat charged on all goods and services supplied in the. This is the total amount of vat charged on sales. Click the adjust link in the box 1 row. Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. Include the vat due in this period on imports accounted for through postponed vat accounting. Select the vat return, then click prepare return. Web vat return box 1:

from support.freeagent.com

Uk vat registered businesses should also. Vat due on sales and other outputs this box should include the total amount of vat charged on all goods and services supplied in the. Fill in the necessary fields, then click. This is the total amount of vat charged on sales. This might also include vat on other outputs, such as. Click the adjust link in the box 1 row. Select the vat return, then click prepare return. Web vat return box 1: Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. Vat due on sales and other outputs.

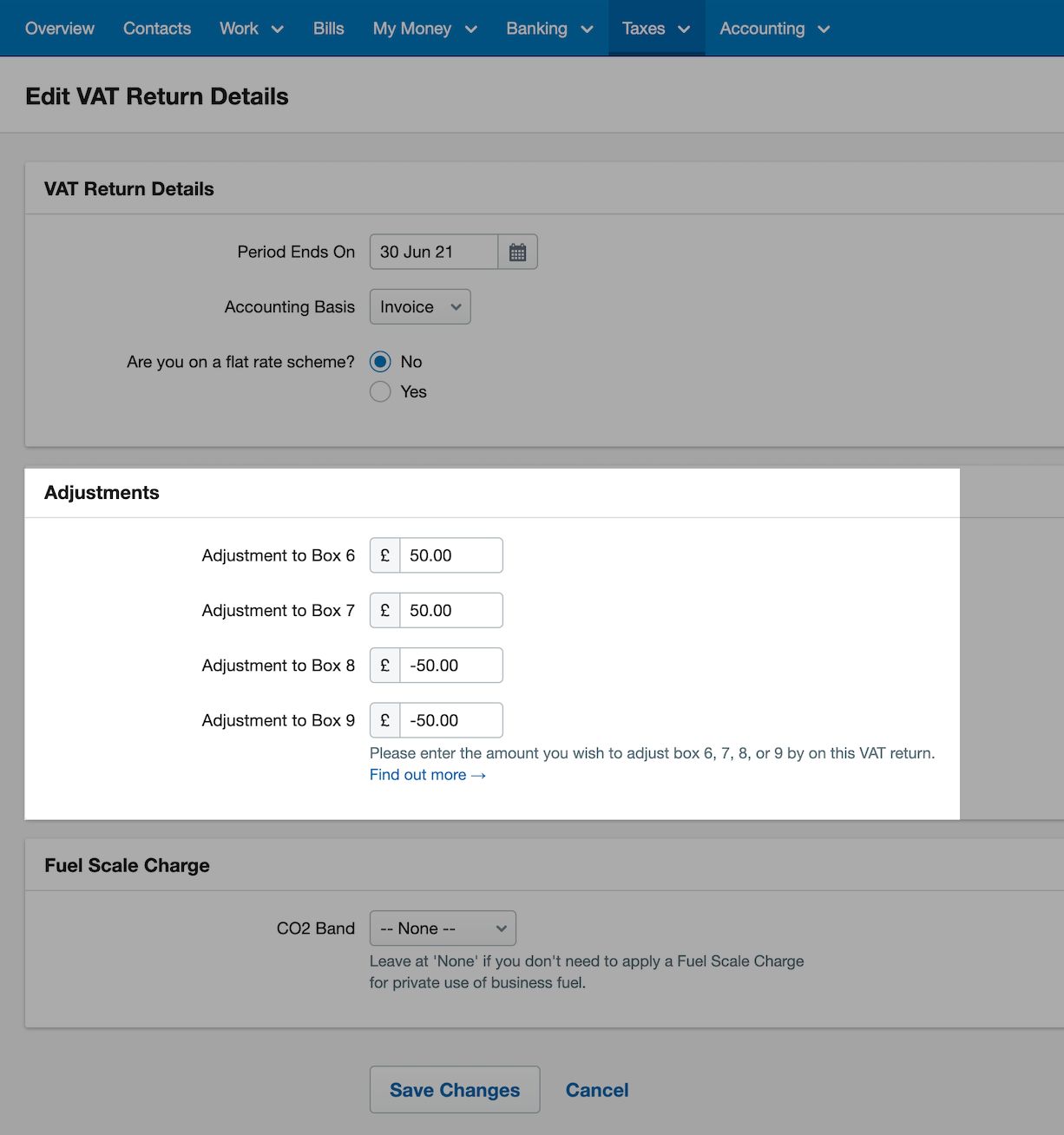

How to adjust boxes 6 to 9 of your VAT return FreeAgent

What Is Box 1 On Vat Return This is the total amount of vat charged on sales. Click the adjust link in the box 1 row. Vat due on sales and other outputs this box should include the total amount of vat charged on all goods and services supplied in the. Fill in the necessary fields, then click. Web vat return box 1: Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. This is the total amount of vat charged on sales. Vat due on sales and other outputs. Include the vat due in this period on imports accounted for through postponed vat accounting. Web click taxes, then go to the vat tab. Uk vat registered businesses should also. Select the vat return, then click prepare return. This might also include vat on other outputs, such as.

From support.freeagent.com

How to adjust boxes 6 to 9 of your VAT return FreeAgent What Is Box 1 On Vat Return Web vat return box 1: Click the adjust link in the box 1 row. Include the vat due in this period on imports accounted for through postponed vat accounting. Fill in the necessary fields, then click. Vat due on sales and other outputs. This might also include vat on other outputs, such as. Select the vat return, then click prepare. What Is Box 1 On Vat Return.

From www.freeagent.com

What is a VAT return? FreeAgent What Is Box 1 On Vat Return Click the adjust link in the box 1 row. Fill in the necessary fields, then click. Web click taxes, then go to the vat tab. This is the total amount of vat charged on sales. Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. Vat due on sales. What Is Box 1 On Vat Return.

From support.freeagent.com

How to adjust boxes 1 and 4 of your VAT return FreeAgent What Is Box 1 On Vat Return Uk vat registered businesses should also. Vat due on sales and other outputs this box should include the total amount of vat charged on all goods and services supplied in the. This is the total amount of vat charged on sales. Web vat return box 1: Web click taxes, then go to the vat tab. Fill in the necessary fields,. What Is Box 1 On Vat Return.

From www.kashflow.com

How To Do A VAT Return Knowledge Base IRIS KashFlow What Is Box 1 On Vat Return Select the vat return, then click prepare return. Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. Vat due on sales and other outputs this box should include the total amount of vat charged on all goods and services supplied in the. Vat due on sales and other. What Is Box 1 On Vat Return.

From goselfemployed.co

How to Complete Your First VAT Return What Is Box 1 On Vat Return Uk vat registered businesses should also. Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. Include the vat due in this period on imports accounted for through postponed vat accounting. Web click taxes, then go to the vat tab. Click the adjust link in the box 1 row.. What Is Box 1 On Vat Return.

From www.youtube.com

UAE VAT Return Box No 1 Standard Rated Supplies YouTube What Is Box 1 On Vat Return Vat due on sales and other outputs. This is the total amount of vat charged on sales. Vat due on sales and other outputs this box should include the total amount of vat charged on all goods and services supplied in the. Uk vat registered businesses should also. Web in this post, we will outline the fundamentals of each vat. What Is Box 1 On Vat Return.

From www.bokio.co.uk

How to understand and review your VAT return Bokio What Is Box 1 On Vat Return Web click taxes, then go to the vat tab. Fill in the necessary fields, then click. Select the vat return, then click prepare return. This might also include vat on other outputs, such as. Uk vat registered businesses should also. This is the total amount of vat charged on sales. Web in this post, we will outline the fundamentals of. What Is Box 1 On Vat Return.

From www.youtube.com

Overview of VAT return filing procedures applicable for VAT returns of What Is Box 1 On Vat Return Select the vat return, then click prepare return. Include the vat due in this period on imports accounted for through postponed vat accounting. Web click taxes, then go to the vat tab. Web vat return box 1: Vat due on sales and other outputs. This is the total amount of vat charged on sales. Uk vat registered businesses should also.. What Is Box 1 On Vat Return.

From support.clearbooks.co.uk

Clear Books Support What Is Box 1 On Vat Return Fill in the necessary fields, then click. Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. Vat due on sales and other outputs. Uk vat registered businesses should also. Vat due on sales and other outputs this box should include the total amount of vat charged on all. What Is Box 1 On Vat Return.

From support.freeagent.com

Checking, editing and locking a VAT return FreeAgent What Is Box 1 On Vat Return Vat due on sales and other outputs. This might also include vat on other outputs, such as. Click the adjust link in the box 1 row. Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. Web click taxes, then go to the vat tab. Web vat return box. What Is Box 1 On Vat Return.

From www.zoho.com

VAT Returns Help Zoho Books What Is Box 1 On Vat Return Include the vat due in this period on imports accounted for through postponed vat accounting. Web click taxes, then go to the vat tab. Uk vat registered businesses should also. Vat due on sales and other outputs this box should include the total amount of vat charged on all goods and services supplied in the. Select the vat return, then. What Is Box 1 On Vat Return.

From goselfemployed.co

How to Complete Your First VAT Return What Is Box 1 On Vat Return Web click taxes, then go to the vat tab. Select the vat return, then click prepare return. Uk vat registered businesses should also. Fill in the necessary fields, then click. Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. Include the vat due in this period on imports. What Is Box 1 On Vat Return.

From quickbooks.intuit.com

Solved How do I adjust the figure in Box 1 of my vat return? What Is Box 1 On Vat Return Click the adjust link in the box 1 row. This might also include vat on other outputs, such as. Web click taxes, then go to the vat tab. Vat due on sales and other outputs. Select the vat return, then click prepare return. Fill in the necessary fields, then click. Vat due on sales and other outputs this box should. What Is Box 1 On Vat Return.

From www.tide.co

A guide to domestic VAT reverse charges Tide Business What Is Box 1 On Vat Return Click the adjust link in the box 1 row. Include the vat due in this period on imports accounted for through postponed vat accounting. This might also include vat on other outputs, such as. Fill in the necessary fields, then click. Vat due on sales and other outputs this box should include the total amount of vat charged on all. What Is Box 1 On Vat Return.

From quickbooks.intuit.com

VAT Box 6 What Is Box 1 On Vat Return Fill in the necessary fields, then click. This might also include vat on other outputs, such as. Web click taxes, then go to the vat tab. Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat return. Select the vat return, then click prepare return. Vat due on sales and. What Is Box 1 On Vat Return.

From www.slideserve.com

PPT The VAT Return PowerPoint Presentation, free download ID4851186 What Is Box 1 On Vat Return Click the adjust link in the box 1 row. This might also include vat on other outputs, such as. Select the vat return, then click prepare return. Uk vat registered businesses should also. Vat due on sales and other outputs. Web in this post, we will outline the fundamentals of each vat box and how it contributes to the vat. What Is Box 1 On Vat Return.

From www.youtube.com

How to file a VAT return to HMRC? YouTube What Is Box 1 On Vat Return Fill in the necessary fields, then click. Web vat return box 1: This might also include vat on other outputs, such as. This is the total amount of vat charged on sales. Uk vat registered businesses should also. Vat due on sales and other outputs this box should include the total amount of vat charged on all goods and services. What Is Box 1 On Vat Return.

From support.freeagent.com

How to adjust boxes 1 and 4 of your VAT return FreeAgent What Is Box 1 On Vat Return This is the total amount of vat charged on sales. Vat due on sales and other outputs this box should include the total amount of vat charged on all goods and services supplied in the. Select the vat return, then click prepare return. Web vat return box 1: Click the adjust link in the box 1 row. Include the vat. What Is Box 1 On Vat Return.